Now Accepting Form 2290 for the 2023-2024 Tax Period. File Now and Get your Stamped Schedule 1 in Minutes. E-file Form 2290 Now

VIN Correction

Do you want to correct your VIN? Don’t worry! It is simple as Vincorrection.com provides free VIN Correction to users who have filed the HVUT with us and even if you haven’t e-filed with us, you can still file Form 2290 Amendments at an affordable and low price.

It is common to make mistakes and the same can be said about VIN. As the VIN consists of 17 characters that combines letter and numbers, you are bound to make some typos. Rather than breaking your head and worrying about the wrong VIN at the DMV, you can double check the VIN and file for free correction using Vincorrection.com.

Once you have realized that you have made an error after filing the Form 2290, you can easily send the 2290 VIN Correction form to the IRS for getting the Schedule 1 corrected. With Vincorrection.com, you can not only do free VIN Corrections but even quickly and easily file the 2290 Amendments so that truckers can get their Stamped Schedule 1s and make the necessary corrections.

Click here to learn more about VIN correction https://www.expresstrucktax.com/form2290/vincorrections/

Free VIN

During the filing process, if you accidentally entered the wrong VIN number, you can file the 2290 VIN Correction form to rectify it for free.

100%, US-Based Customer Support

Our experienced customer support executives will assist in filing the VIN Correction for you. Give us a call, live chat or email us regarding any queries or doubts.

Automated Audit Check

Relax and be care-free when filing the 2290 VIN Correction form. Our system will do a detailed scan of your form so that there are no errors when it gets transmitted to the IRS.

IRS-Authorized

As an IRS-authorized e-file provider, you know you're in good hands! We'll make sure that when you e-file Form 2290, your return is being transmitted safely and securely.

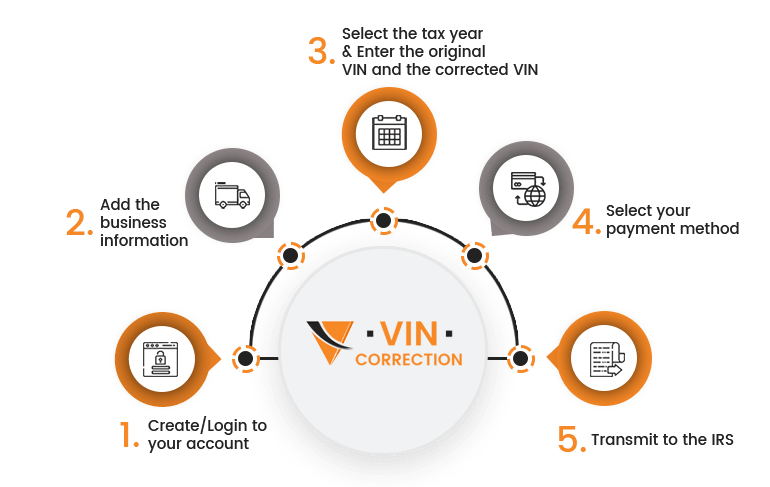

Steps to E-file

- Create/Login to your account

- Add the business information

- Select the tax year & Enter

the original VIN and the corrected VIN - Select your payment method

- Transmit to the IRS